Understanding Actuarial Valuation of Accumulating Sick Leave

Understanding Actuarial Valuation of Accumulating Sick Leave

We often come across clients who are not sure if they need to recognise liability in respect of sick leaves. And in case of companies who do recognise a liability in respect of sick leaves, we often find the management not being aware of the calculation process of the liability.

As a result, many companies do not provide for liability in respect of sick leaves, even when there is mandatory requirement to provide for the same. Furthermore, for the companies that do recognise the liability, we see lack of understanding coming in the way of optimum recognition and proper control over this liability.

In this note, we try to answer some basic questions regarding recognition and measurement of liability in respect of sick leaves.

Recognition: When does one needs to recognise liability in respect of sick leaves?

As per AS15 (as well as Ind AS 19 and IAS 19), the entitlement to compensated absences falls into following categories:

- Accumulating leaves: Accumulating compensated absences are those that are carried forward and can be used in future periods if the current period's entitlement is not used in full. Accumulating compensated absences may be either :

- Vesting leaves i.e. employees are entitled to a cash payment for unused entitlement on leaving the enterprise; or

- Non-vesting i.e. when employees are not entitled to a cash payment for unused entitlement on leaving.

- Non - Accumulating: Accumulating compensated absences are those that cannot be carried forward.

Para 14 of the Accounting Standard (AS) 15 states:

“An enterprise should measure the expected cost of accumulating compensated absences as the additional amount that the enterprise expects to pay as a result of the unused entitlement that has accumulated at the balance sheet date.â€

Thus, if the sick leaves offered are accumulating i.e. they can be carried forward (whether vesting or non-vesting), the obligation for the same is required to be measured and recognised at the balance sheet date.

Hence, even if the carried forward sick leaves cannot be encashed but only be availed in the future period, the same needs to be provided for. Para 13 of AS15 clarifies the situation in this regard, which states as under:

“An obligation arises as employees render service that increases their entitlement to future compensated absences. The obligation exists, and is recognised, even if the compensated absences are non-vesting, although the possibility that employees may leave before they use an accumulated non-vesting entitlement affects the measurement of that obligation.â€

Measurement: How do you put a number to liability in respect of accumulated sick leaves?

Sick leaves are often not allowed to be encashed (i.e. they are non-vesting). In such a case, the obligation measurement is based on projected availment of sick leaves accumulated as on the date of valuation. Thus, rate of future availment of leaves becomes the key assumption in such valuations.

In most cases, leave valuations are carried out assuming a Last-In-First-Out (LIFO) basis of leave consumption. Consequently, it is assumed that all leaves to be availed in future are going to be first consumed out of future accruals and only excess consumption of leaves (i.e. over and above future accruals) will be consumed out of the closing leave balance being currently valued.

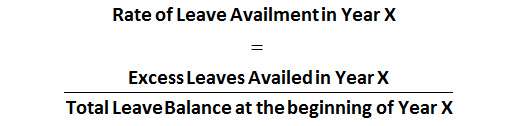

Thus, when getting the sick leave valued, it is the assumption regarding the rate of future excess availment of leaves that must be determined to put a value on the liability. This assumption is an explicit rate of leave availment during employment, which is determined considering the past trends indicated by the following ratio and must be stated explicitly in any actuarial valuation of sick leaves:

Suppose there were 10 employees in an organization during year X. Assume that nine of them availed leaves that were less than the number of leave that accrued during the year. For all these nine employees, the ‘excess leaves availed’ to be considered in the numerator in the above formula shall be 0. For the 10th employee who availed more leaves than the number of leaves that accrued to him, only the leaves availed in excess of leaves shall be considered in the numerator of the above formula. In the denominator, though, the total leave balance for all the 10 employees at the beginning of the year X shall be considered.

The above ratio should be found out for the past 2 or 3 years (if available or else at least for one complete leave cycle) and the average of the same can be used as the assumption for rate of leave availment during employment. Typically, we have seen this rate to be less than 2% as largely the employees avail less leaves than they accrue in a year. Consequently, their contribution to the numerator is 0 whilst their entire leave balance is considered in the denominator.

Please note that value of sick leave liability is extremely sensitive to this assumption. Thus, typically, a high rate of leave availment means a higher liability. Hence, the Companies are advised to carefully assess the pattern of leave availment before incorporating the same in the valuation of sick leave liability.

Concluding advice to Companies and Auditors

Having understood the above, our advice to the Companies and Auditors is to ensure the following with regards to sick leaves:

I trust you will find the information in this note useful. I thank you for reading this note and welcome any comments or recommendations or observations you may have on the subject. You can direct those to the email address mentioned below.

Khushwant Pahwa, FIAI, FIA, B Com (H)

Founder and Consulting Actuary

KPAC (Actuaries and Consultants)

k.pahwa@kpac.co.in

www.kpac.co.in